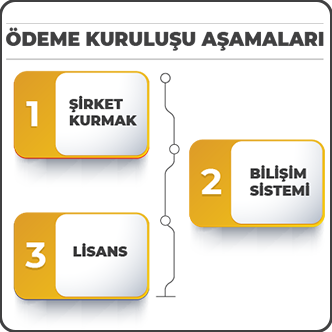

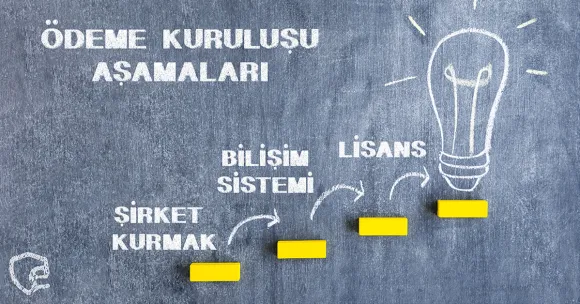

HOW TO ESTABLISH A PAYMENT INSTITUTION IN THREE STEPS?

Hello Everyone!

In our previous article, we thoroughly answered the question, “What is a payment institution?” You can read that article by CLICKING HERE. In this article, we will focus on how payment institutions can be established and how to obtain an operational license.

Payment institutions are established under the Law No. 6493 on Payment Services and Electronic Money Institutions. This law and its sub-regulations (regulations, communiqués, etc.) provide answers to questions such as how to establish a payment institution, how to obtain an operational license, and how to run it. Legal texts can sometimes be confusing, so based on our past experiences, we wanted to create this blog post and explain the process step by step in simpler terms.

Step 1: Establishing the Company

Establishing a company may sound simple, but to establish a Payment Institution, it must be an Incorporated Company under the relevant law and regulations. There are rules regarding how, within what framework, and for what purpose the payment institution will be established, including its legal title. For instance, a payment institution cannot be named “ABC Construction and Transportation Ltd.” Instead, it should follow the format of “ABC Payment Services Inc.” Every detail, from the company’s articles of incorporation to its assets, must comply with the legislation.

The company must also prepare its board of directors and organizational structure in this step. This structure should include functions like risk management, IT, internal control, and accounting. The hiring processes for these positions must align with this organizational chart, which should be maintained throughout the licensing process. The cost of maintaining this organizational structure should also be calculated in detail. Based on our consultancy and IT services experience, the minimum cost for maintaining this structure is observed to be approximately 60,000 to 80,000 TL per month. After this step, the speed of the subsequent stages until the operational license is granted is crucial for both cost and the profit/loss from operations.

The organization must also have a paid-in capital that varies depending on the operational areas it applies for. Under the current law, this amount ranges from 1,000,000 TL to 5,000,000 TL. For example, a company applying solely for payment services must have a capital of 2,000,000 TL. Since most payment institutions also apply for “Electronic Money Institution” operational licenses, they generally pay 5,000,000 TL. A common misconception is that this payment is a license fee. In reality, this amount remains the company’s asset. Although its use is restricted, it can be issued as electronic money under certain conditions. Another aspect to note is that the competent authority may increase this amount. All these figures represent minimum requirements, and the organization may choose to operate with a higher paid-in capital.

Step 2: Payment Institution IT System

The most critical component of a payment institution is the IT system it will use. Unlike traditional banks, payment institutions do not have physical branches, and almost all processes are conducted through this IT system. Organizations can either develop this system in-house or outsource it. Outsourcing is often preferred due to its cost-effectiveness and sustainability.

Before obtaining an operational license, this IT system must be audited by an independent audit firm to obtain a report. During the licensing process, the competent authority (currently the Central Bank of Turkey) will also review this IT system in detail during a board meeting.

This IT system, essentially a banking system, must be meticulously tested according to all technical standards of the industry. Any errors in this system can lead to significant financial losses. For example, an integration error between the payment institution and intermediary banks could cost millions of liras within a few hours. Therefore, integration testing must be conducted with great care and detail. You can find more information about the technical requirements of Payment Institution IT Systems in a separate article.

The second step involves four sub-steps:

- IT system setup and testing process (Usually 1-2 weeks, but months for in-house development)

- Independent auditing of the IT system (1 week to 2 months)

- Regulatory auditing and testing during licensing (1-2 months)

- System integration and operation process (1-2 weeks)

Step 3: Operational License (License)

In this step, all documents related to company establishment, organizational structure, and the IT system are ready. The payment institution applies to the competent authority for an operational license. The application file includes documents such as independent audit reports, organizational charts, partnership structures, and application forms. After submission, a board meeting may approve the license, request changes, or reject the application. Approved institutions are published in the Official Gazette with their name and activities.

Once licensed, the payment institution can sign contracts with intermediary banks and merchants under the title of “Payment Institution.” Integrations with third parties tested during the independent audit process must now be transitioned to live environments and retested. Licensed institutions are also subject to periodic independent audits.